This article originally appeared in the Wall Street Journal. To read it in its entirety, click here.

________________________________________

Title:Â Affordable Care Act Eases Concerns for One Family

Date: December 25, 2014

By:Â Christopher Weaver

Source:Â The Wall Street Journal

Jaime Hood and her family were among the health law’s biggest winners in 2014.

Ms. Hood said she enrolled her 5-year-old son Devyn in the same Blue Cross and Blue Shield of Kansas City plan that covered him in 2014 for another year.

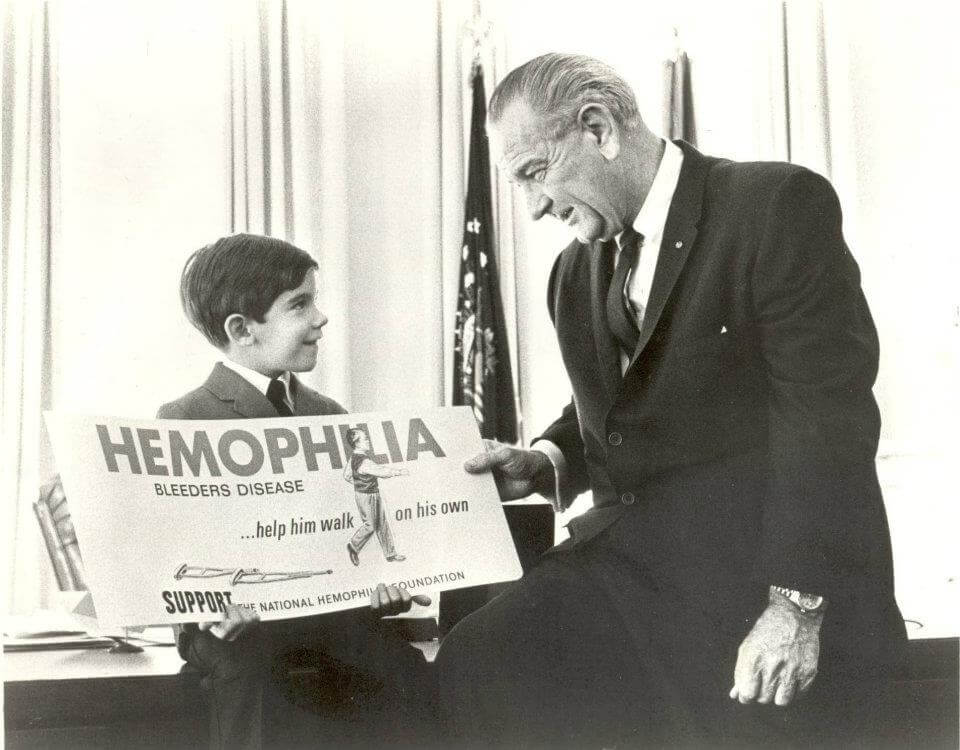

Devyn had never had private coverage before Ms. Hood bought the plan in a new insurance marketplace earlier this year. Because Devyn has a serious form of the blood disorder hemophilia, private insurers wouldn’t offer him coverage before.

He takes a medicine to treat that disease that costs $74,000 a month; another medicine used for a related condition costs $7,000 a month. Insurers have historically considered hemophilia one of the most costly conditions to cover and often declined to take on customers with the disorder.

But, the law barred insurers from excluding people who have medical conditions, a longtime industry practice. This year, Ms. Hood has paid about $187 a month for Devyn’s insurance.

That price is rising next year by about $20, or 11%, Ms. Hood said, adding that she hadn’t yet seen a bill for his 2015 coverage and was relying on an estimate by a company sales representative.

Some consumers who saw prices rise for next year have shopped around for new plans. In some cases the most affordable plans in 2014 saw rates rise and surpass rival insurers’ offerings.

But because the Blue Cross plan includes Devyn’s doctors in its network, Ms. Hood said she wouldn’t seek a better deal.

“As long as nothing changes, I don’t think we’ll do anything differently,” Ms. Hood said. “We’re more focused on the network” than the price, she said.

Before the law’s main coverage provisions went into effect in January 2014, Devyn was enrolled in Missouri’s state-run Medicaid program, which covers low-income and certain disabled people.

But because Ms. Hood earned more than the income threshold for that type of coverage, she was required to pay more than $900 a month in medical bills before the Medicaid plan kicked in. If she had earned more, that amount would have increased.

Since Devyn has been enrolled in the Blue Cross plan, Ms. Hood has begun to work full time, increasing her income by about 50% and gaining private coverage for herself through her employer, a local medical company.

Ms. Hood and her boyfriend, Tom, are also now talking about getting married; before, that prospect would have meant combining their incomes and putting Devyn’s Medicaid coverage out of reach.

“It has opened that opportunity up for us where we don’t have to worry about Devyn losing health insurance if we marry,” Ms. Hood said. “It is a huge aspect of health insurance for a lot of people.”