Make Sure All Copays Count

Many in the bleeding disorders community rely on patient copay assistance programs to help defray the out-of-pocket (OOP) cost of their prescription drugs. Unfortunately, health insurers increasingly are refusing to credit copay assistance toward patients’ deductibles and OOP maximums. This practice (“copay accumulator adjustment”) puts patient health and financial security at risk.

Background

Copay accumulator adjuster programs (CAAPs) are a relatively new cost-containment tactic that has rapidly expanded to the point where they now appear in more than 80% of commercial health plans. Plans sometimes spring CAAPs on consumers in the middle of a plan year, and conceal their existence in plan documents that are hundreds of pages long, disguising them under confusing names like “out-of-pocket protection programs” or “specialty copay solutions.”

(“Copay maximizers,” commonly found in self-funded health plans, are a variation of CAAPs. Maximizers are structured in such a way that the patient never encounters a surprise bill when they go to refill their prescription – but the plan still refuses to count the assistance dollars toward the patient’s cost-sharing obligations.)

Impact

CAAPs create significant confusion, financial risk, and barriers to care for consumers. Patients discover that they can’t afford to remain on their medications: they may find that they are forced to discontinue treatment, or have to turn to emergency rooms for care of acute health episodes. Both options lead to bad health outcomes AND higher health care spending overall. Patients exposed to sky-high, year-after-year OOP costs face threats to their financial security as well as their physical wellbeing.

What is Being Done to Prevent Accumulator Adjusters?

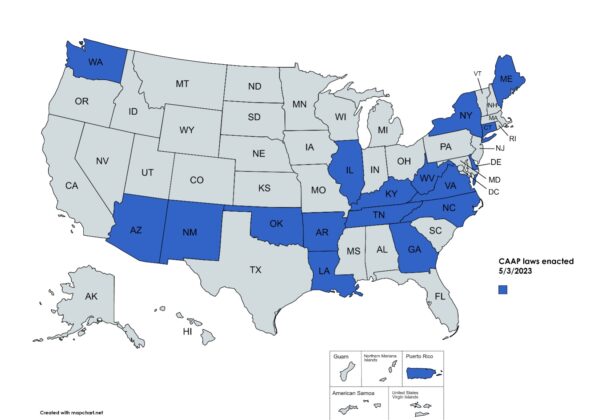

To date, 17 states and one territory have passed laws prohibiting or limiting the use of accumulator adjusters for all individual and small group plans regulated at the state level.

Congress continues to consider federal legislation that would prohibit or limit the use of accumulator adjusters by plans regulated by the federal government (large employer and self-funded plans) as well as plans that are state-regulated.

HFA’s Position

All copays count! Lawmakers should protect patients from high out-of-pocket costs by requiring health plans to credit all payments made by or on behalf of patients toward patient deductibles and out-of-pocket maximums. Copayment accumulator adjusters endanger patient health and well-being.

Further FAQS

Is copay assistance the same thing as a coupon or “copay card”?

Copay assistance is different from copay cards or drug coupons. Copay assistance (from non-profits, charities, or drug manufacturers) changes how a patient pays their cost-sharing, rather than what they pay. Copay assistance (in contrast to copay cards or coupons) is only available for patients with chronic conditions such as bleeding disorders who need specialty medications to manage their disease and who meet specified income and eligibility criteria. For these patients, copay assistance is often the only way they can afford the out-of-pocket costs for their life-saving medications.

Does copay assistance increase the use of expensive medications?

No! For conditions such as bleeding disorders, no generic and no low-cost alternatives exist. And health insurers still have control of what treatments patients can access, using their traditional tools of formulary design, prior authorization, etc. Patients must still gain approval from the insurer to gain access to the medication at issue.

What happens when copay assistance is not allowed to count?

When an insurer applies a copay accumulator, the insurer collects double (or even more than double) the amount of a patient’s required cost-sharing: once from the copay assistance program and then, when the assistance dollars are depleted, the full amount of the cost-sharing (again) from the patient. On the patient’s side, all too often, the result is that the patient encounters an unexpected and unaffordable charge for their drug refill. The patient, if unable to pay, may be forced to abandon their prescription, discontinue therapy, and potentially end up in the emergency room for treatment of an acute (and avoidable) health issue.

Are rules different for people who are enrolled in high-deductible health plans?

Federal regulators have decided that Internal Revenue Service guidance from 2004 prevents consumers in high-deductible health plans (HDHPs) from using copay assistance while they are still within their plan deductible. This IRS rule makes it harder to protect HDHP enrollees from copay accumulator adjusters. Patient advocates have sought to limit the impact of the IRS rule by supporting the inclusion of “savings clause” language in state CAAP legislation. The savings clause clarifies that CAAP protections kick in for HDHP enrollees as soon as they have paid the statutorily-defined portion of their annual deductible that makes them eligible to contribute to a health savings account: $1,500/individual or $3,000/family, rather than the full deductible (which may be as high as $7,500/individual or $15,000/family in 2023).

Resources

- Copay Accumulators Explained (video)

- The AIDS Institute report, Copay Accumulator Adjustment Policies in 2023

- Allcopayscount.org

- Aimed Alliance Copay Accumulator 101

Updated May 2023